About ABNB

At ABNB, You’re Able To Do More With Your Money

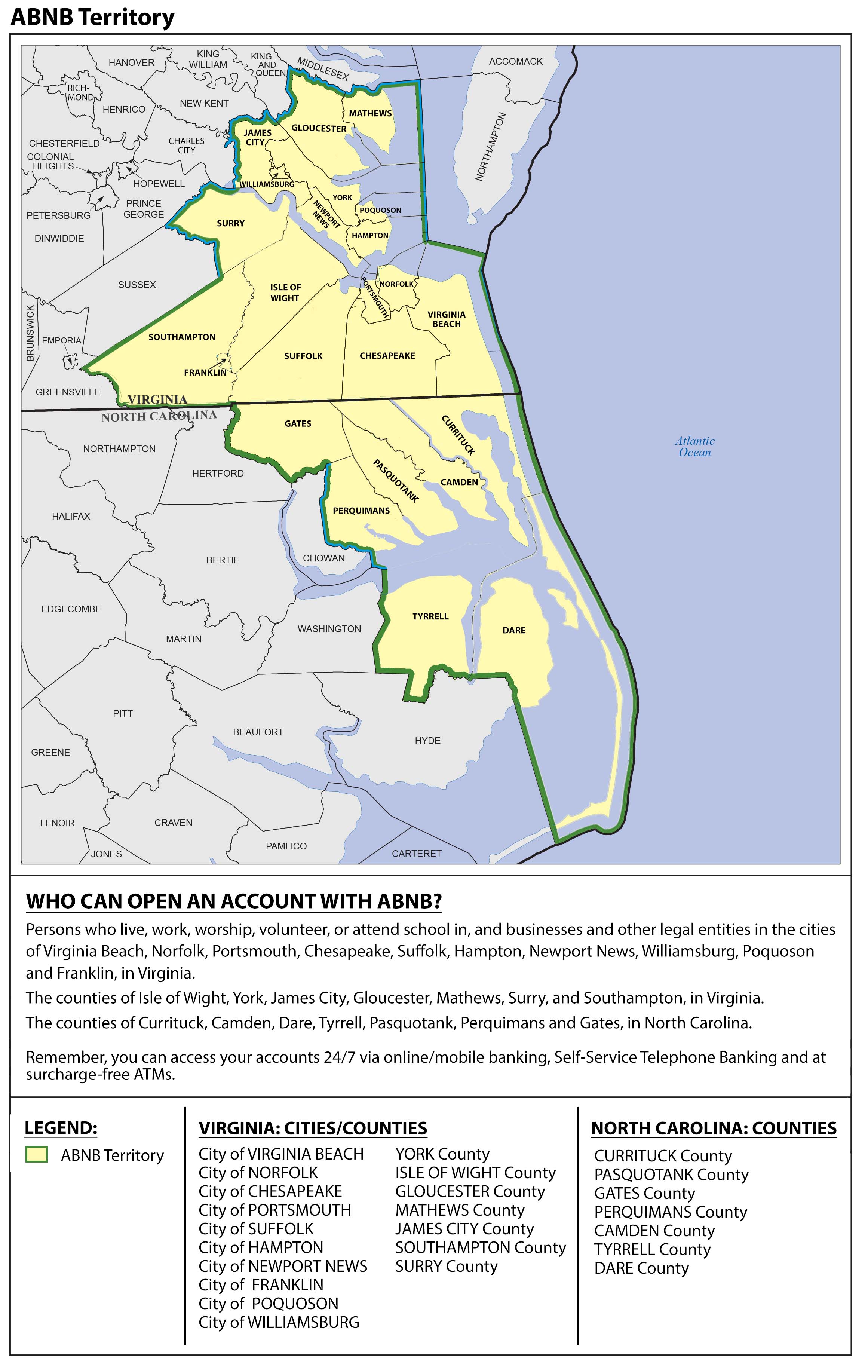

The credit union began as NavPhiBase Federal Credit Union in 1960 with 8 members and $40 in deposits. Today, we are ABNB Federal Credit Union celebrating over 62 years of serving members. As a member owned financial institution, we’ve grown to over 78,000 members, have over $780 million in assets, and are a regional financial institution serving members in Greater Hampton Roads and Northeastern North Carolina through the Outer Banks. Regardless of our size, our goal has always been and will always be to serve our member’s total financial needs.

The reason we exist is to serve you, and everything we do at the credit union is done with the success and financial health of our members in mind. We feature higher rates on deposits, lower rates and affordable terms on loans, plus low/no fees which saves you money every day vs. banks and other for-profit financial institutions. In fact, we’re all about “People Not Profits” because your prosperity and financial well-being are the best measure of our success.

Membership has its advantages, so we welcome you to become a member of the ABNB family today.

Open an account online today!

{beginAccordion h2}

Vision, Mission, and Value Statement

Our Vision Statement

To be the most trusted lifetime financial partner in the communities we serve.

Our Mission Statement

Providing financial services in a manner that improves our members' lives and benefits the communities we serve.

Our Value Statement

Trust earned through integrity.

The History of ABNB

1960

History was made when the Credit Union first opened its doors under the names ComFive Federal Credit Union. The Credit Union was founded on principles that include honor, integrity, value, and convenience. The initial goal of ComFive Federal Credit Union was to be its members' most trusted lifetime financial partner.

1976

The newly renovated Credit Union at NavPhiBase celebrated its grand opening November 29, 1976. Public Works spent approximately six weeks preparing the location to accommodate the new Credit Union. The new location, according to then manager Robert Morgan, improved employees attitudes so greatly that they pitched in two Saturdays and one evening to help with painting and cleaning.

1984

This year was the first for the Credit Union and the “Automatic Teller.” The automatic teller offered a quick and easy way for members to obtain cash during and after business hours. Additionally, Naval Base Norfolk Federal Credit Union and Navy Federal Credit Union (Washington, DC) agreed to install a shared automatic teller machine (ATM) network for use by the members of both Credit Unions.

1996

The merger of Amphibious Base FCU and Naval Base Norfolk FCU occurred in 1996. The name ABNB stood for Amphibious Base Naval Base. The mission of ABNB Federal Credit Union was simple - to deliver financial services in a manner that improved our members’ lives and benefited our community.

1999

During the year 1999, testing for Y2K was constant in order to gear up for 2000. Additionally, ABNB continued in its efforts to remain “People Helping People” as ABNB emphasized the idea that credit unions are “ Where People Are Worth More Than Money.” With this philosophy in mind, ABNB focused its efforts on community events, such as Habitat for Humanity.

2004

In order to follow the strategic plan for the opening of new offices to serve members and potential members, branches were opened in 2004 at Town Point in Suffolk and another office in Moyock, North Carolina. The highlight of the year was the grand opening in March of the new Operations Center, located in the Greenbrier Business Park in Chesapeake, Virginia.

2009

In spite of tough economic times, 2009 remained a successful year for the Credit Union. During this time, ABNB saw the opening of new and replacement branches, including Chesapeake Square and Towne Place in Chesapeake, and Lakeside in Suffolk. Furthermore, 2009 became the biggest year for our Annual CHKD Fishing Fest, with ABNB raising over $52,000 - an increase of more than $7,000 from the previous year.

2022

More than 60 years later, ABNB Federal Credit Union remains committed to expanding and improving upon our products and services, all while providing member service that is outstanding in all respects. We remain committed to providing the membership with a financial institution that is second to none.

Transparency TV

ABNB is deeply committed to delivering Financial Education for our members. We also aim to take the mystery out of financial services and be transparent about how we do business to help members improve their financial lives. To follow through on these commitments, we have created a fun, educational and informational video series called Transparency TV. Each short 1-2 minute video tackles a different financial services topic. We’re going to show you things that the other guys may not tell you, and if you’re not careful, you might learn something you didn’t know before. Enjoy!

Introducing Transparency TV: Performance Money Market Accounts

With your ABNB Performance Money Market account, you’ll appreciate one of the best ways to save without losing accessibility to your money. Click here to learn more about our Performance Money Market Accounts.

The Difference Between Credit Unions and Banks

Unlike banks, credit unions are all about people, not profits.

Alexa Enabled Mobile Banking at ABNB

Enjoy the convenience of accessing your ABNB accounts 24/7, hands-free on your Alexa device from wherever you are. Click here to learn more about Alexa-Enabled Mobile Banking.

Credit Union True or False

A little Credit Union trivia. See how many you can get right, and learn why Credit Unions are better than banks!

Branches, Shared Branches and ATMs

It’s easy to access all your accounts at ABNB using branches, shared credit union branches, online/mobile banking and a nationwide network of surcharge-free ATM's. View our shared branches and ATM locations here.

Serving Members for Over 60 Years

ABNB has proudly been serving members for over six decades providing great low rates and affordable terms on loans, high rates on deposits, plus Insurance, Investment Services, Business Services and more.

Focused on People, Regardless of Their Financial Status

The credit union works every single day to help people in our community, regardless of their financial standing. In fact, we help members from all walks of life on a daily basis, especially the folks that banks have forgotten.

How Credit Unions Are Committed To Giving Back To The Communities

ABNB has a long and storied history of charitable giving and community involvement. Beyond the credit union’s annual charitable giving, The ABNB Community Foundation also provides additional financial support to local non-profits helping families and children in need across the region.

ABNB Member Testimonials

ABNB Financial Coaching

Mr. Callahan worked with our Financial Education Team to improve his finances. Here's his story:

ABNB Business Services

Mr. Forsyth worked with our Business Services Team to assist with his businesses. Here's his story:

ABNB Collections

Mr. Byrne worked with our Collections Team to help him manage a new business. Here's his story:

We're able to help you, too!

{endAccordion}