First-Time Homebuyers Program

First-Time

Homebuyers Program

Buying your first home

in a tough market?

We'll give you the

advantage you need.

![]()

Your Home Loan Advisor will be with you

every step of the homebuying process.

ABNB Home Loan Advisors can be your trusted guide to get you into your first home with personalized help.

We'll make your home buying experience easy and stress-free.

|

Step 1

Connect With A We will match you with your very own loan advisor who will review your application with you and issue your approval letter. |

Step 2

Find Your New Home We can connect you with top-rated Real Estate agents in your area that'll help you find the right home to fit your family and budget. |

Step 3

Offer and Loan Process We help lock-in your rate and begin processing your loan. We're there to help guide you every step of the way. |

Step 4

You're Almost There We assist you in acquiring home owners insurance, double check your documents and rates then prepare your closing paperwork to seal the deal. |

First-time homebuyers can

receive up to $7,500* in a

down payment grant that

doesn't have to be paid back.

Two Of Our Best Loans

+ 30 year fixed is based on 80% LTV with a purchase price of $250,000. All loans subject to approval. Rates, terms and conditions subject to change. May vary based on creditworthiness and qualifications. Does not include taxes or insurance. ++ 10-year fixed rate is based on 95% LTV adjusts every 5 years thereafter, 30-year amortization. Purchase price of $250,000. All loans subject to approval. Rates, terms and conditions subject to change. May vary based on creditworthiness and qualifications. Does not include taxes or insurance. |

|---|

![]()

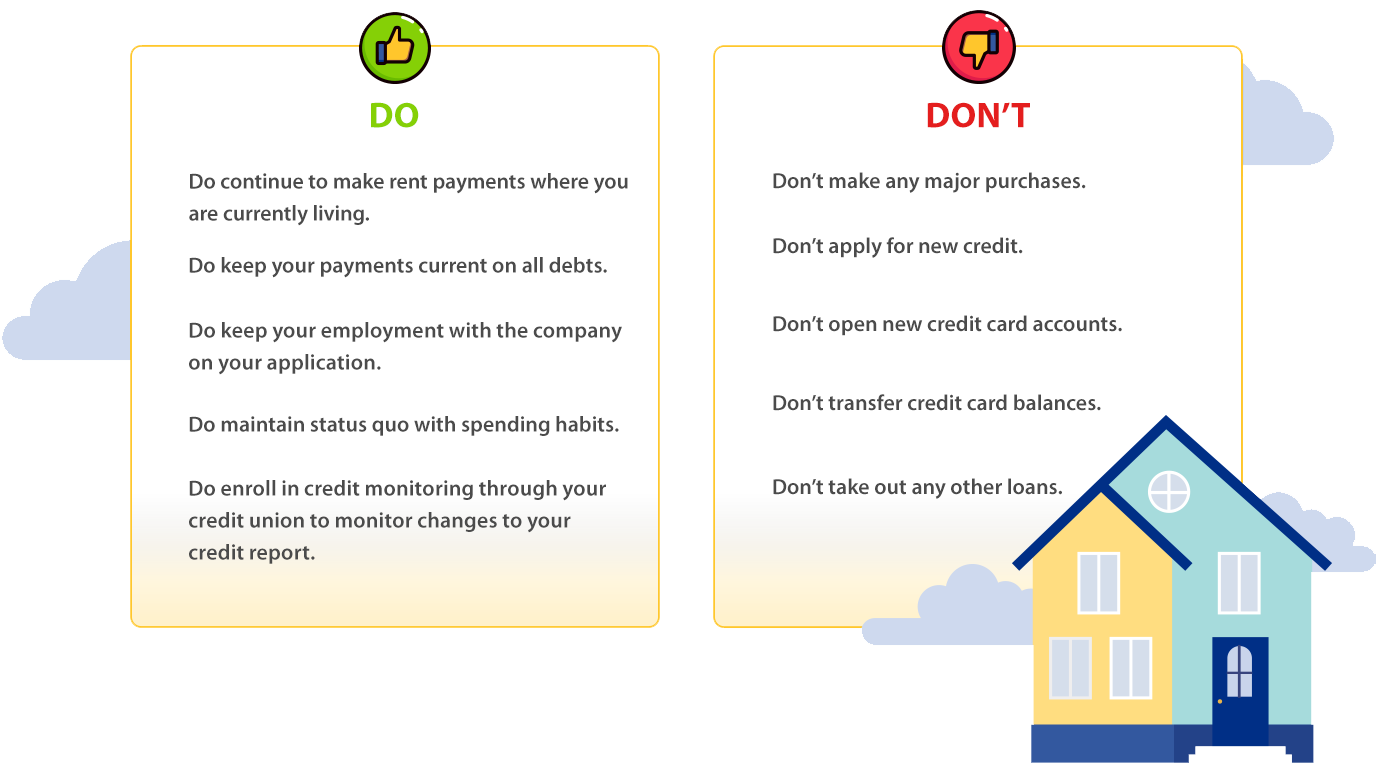

How To Increase Your Approval Odds: Do's & Don'ts

Your income, expenses and your credit score all heavily factor into your lending approval. Treat them with care! You've set your sights on being a homeowner and you've received your approval from your mortgage banker. It's all smooth sailing from here until closing, right? Not quite. If your financial situation changes at any time from when you applied until when you close, your mortgage loan may be impacted.

Mortgage Tools and Calculators

Use our mortgage tools and calculators to see what you can afford and get a breakdown of your taxes,

payments and interest rates.

| Mortgage Calculator Use this calculator to determine your monthly mortgage payment. |

| Mortgage Qualifier Calculator Can you buy your dream home? Find out just how much you can afford! |

| Home Rent Vs. Buy Calculator Are you better off buying your home, or should you continue to rent? |

| ARM Vs. Fixed-Rate Calculator Use this calculator to compare a fixed rate mortgage to a Fully Amortizing ARM. |

| Home Budget Analysis Calculator Analyze your budget, see where you money goes and find out where you can improve! |

The Difference Between Pre-Approval and Pre-QualificationIt's important to understand the difference between being pre-approved for a mortgage and being pre-qualified.

|

|---|

*First-Time Homebuyers maximum subsidy $7,500. Borrower minimum contribution $1,000. Income eligibility requirements apply. Other restrictions may apply.