Understanding Your Escrow Analysis Statement

What is escrow and do I have it?

Escrow is an account balance tied to your mortgage loan to pay your escrowed entities whenever they become due. Escrowed entities can include property taxes, insurance, and/or private mortgage insurance (PMI) when applicable. You can tell if you have escrow by reading your disclosure, reviewing your loan payments, or contacting the credit union.

How is my escrow payment calculated? - Escrow payments are calculated by adding the annual amount of escrowed entity’s payments and dividing this amount by 12 (months).

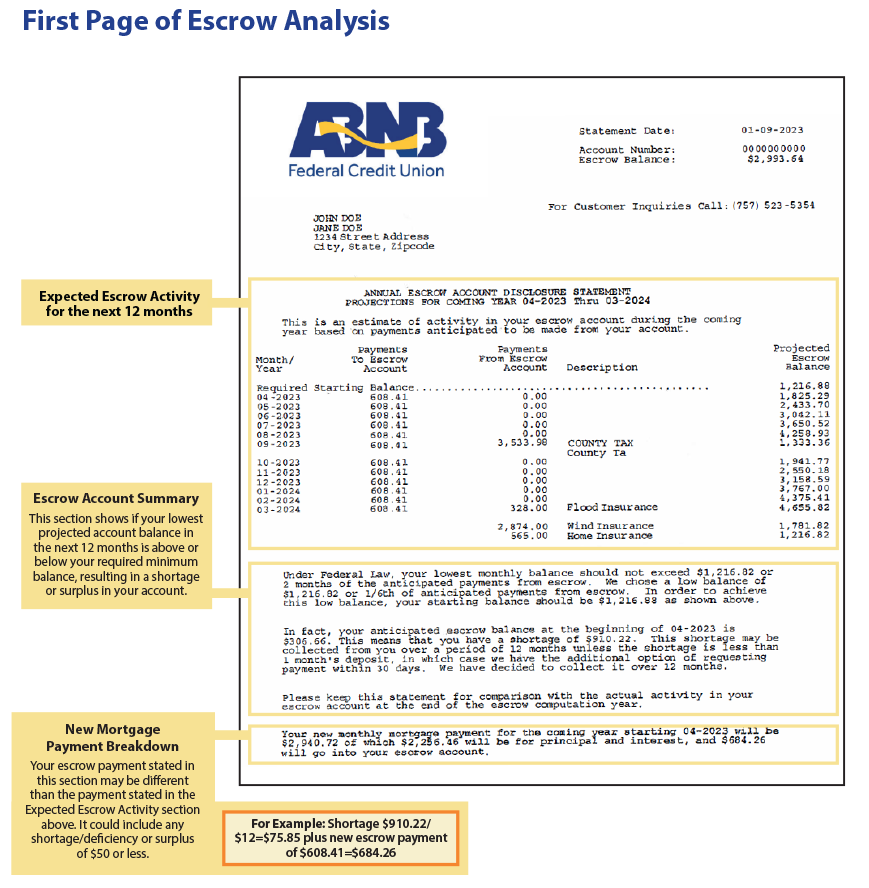

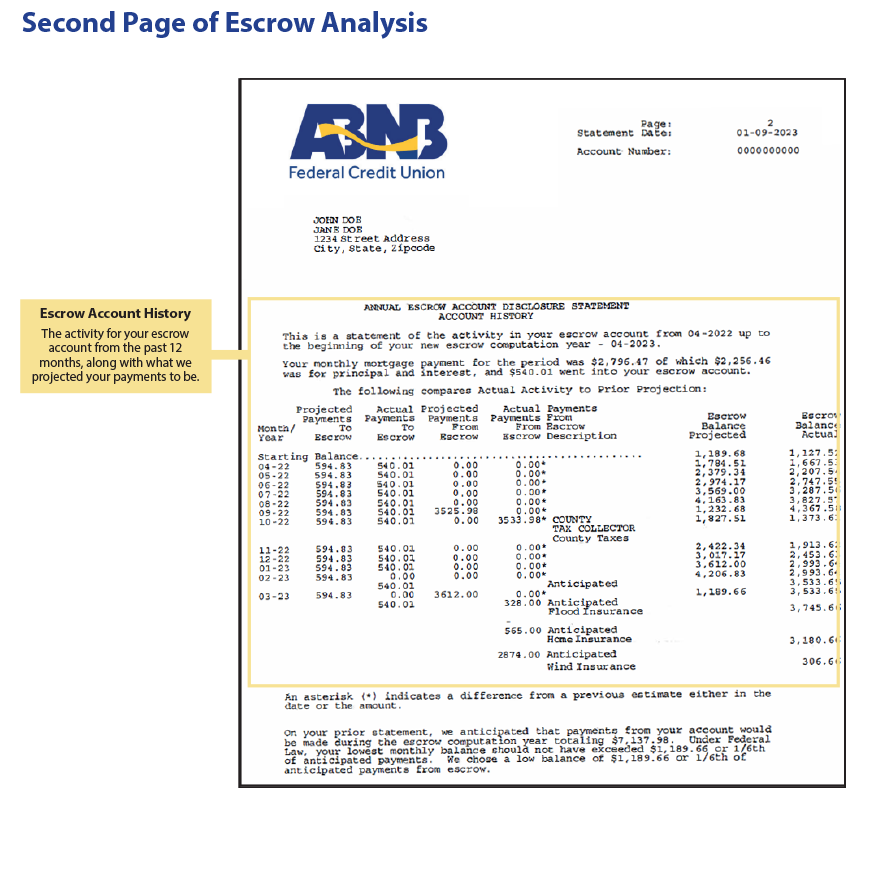

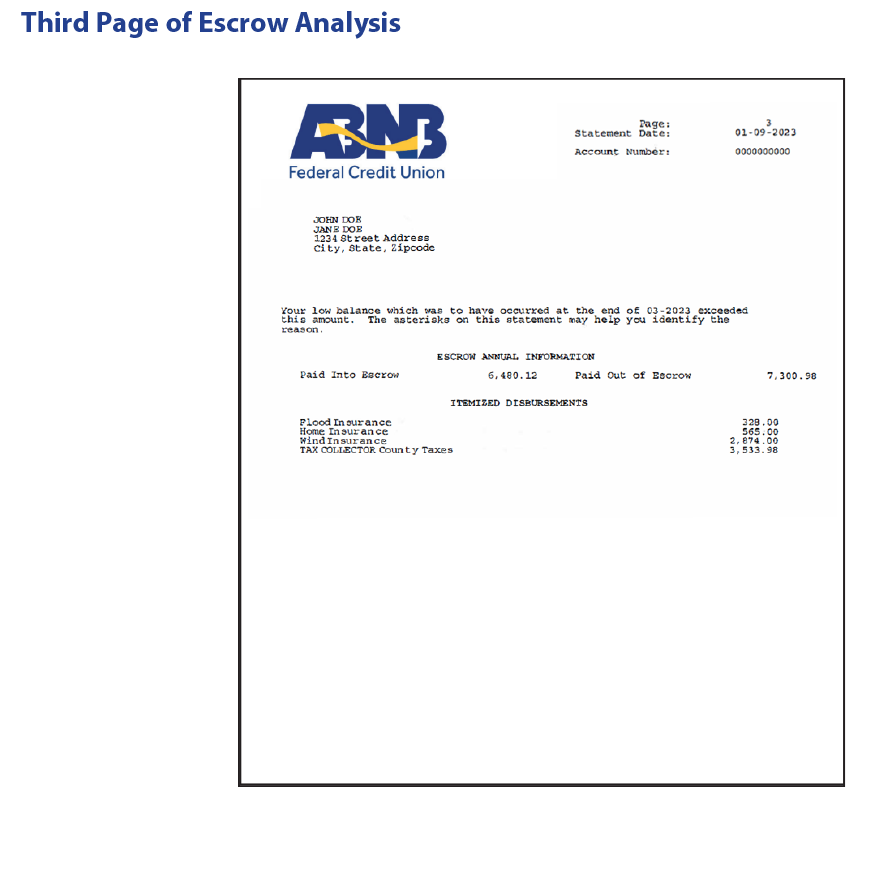

Your escrow analysis statement

First Page - The first page of the statement is your escrow projections for the upcoming year. The credit union reviews your account history with your current monthly payment to determine if your new payment will need to increase or decrease.

Second Page - You’ll see the escrow projections from the previous year. This section shows the differences in your payments from this year compared to last year. This will help you visualize the increase or decrease in your monthly payments.

Third page - A continued overview of the itemized disbursements paid on your behalf.

Surplus, Shortage, Deficiency…What does it all mean?

Now to decipher what it all means. You may see the following words next to a dollar amount on your statement: Surplus, Shortage, and Deficiency.

Surplus means that you paid more than you needed to into your escrow account. Typically, this means that the annual payment for one or more of your escrow entities decreased or remained the same. For example, if your property taxes or homeowners insurance cost decreased from the previous year. That surplus amount goes back directly to you.

Shortage means that you did not pay enough into your escrow account. Typically, this means that one or more of your escrow entities annual payments increased. As your lender, we pay your escrow entities, regardless of your balance. The shortage amount is how much you owe to your escrow account.

Deficiency means that you have shortage, but you are also negative in your escrow account as well. An escrow account requires at least 2 months worth of payments as a cushion, or safety balance. If you have a deficiency, that means you do not have enough money in your escrow account to cover the 2 months of payments and the shortage amount.

Putting It All Together

If you have a shortage or deficiency, that amount will be split into 12 equal amounts and rolled into your escrow payment for the next year.

At the end of your escrow analysis statement there is a recalculation of your escrow payment. If you have a surplus, your monthly payment will decrease if your surplus is $50 or less. If your surplus is more than $50, it will be refunded to you. If you have a shortage or deficiency, your monthly payment will increase.

We hope this has helped you understand more about understanding your escrow account.

If you have any questions, please contact our Mortgage Team at 757.523.5354 or email [email protected].