Checking

Checking Accounts That Fit Your Life

We're pleased to offer a wide array of checking accounts, each with special features and money-saving benefits to fit your lifestyle. Choose the one that's right for you, and simply download the ABNB Value+ app to enjoy all the discounts available to you.

New Members

If you are a current member with a Free & Easy or Legacy checking account…

switching to one of these new accounts is easy as 1, 2, 3. Here are your options:

- Call the Member Service Center at 757.523.5300

- Send a private message inside online banking via the Secure Message Center

- Visit a branch

| Features | Everyday Value | Everyday Earnings | Young Adult/Military | Everyday Freedom |

|---|---|---|---|---|

| Minimum Opening Deposit |

$20 | $20 | $20 | $20 |

| Monthly Fee | $5.95/month | $8.95/month or free with $5,000 average daily balance | $2.95/month | Free with eStatements |

| Free Checks | No | 1st box free ABNB Standard Checks |

No | No |

| Free eStatements |

Yes $4/month paper statement fee |

Yes $4/month paper statement fee |

Yes $4/month paper statement fee |

Yes $4/month paper statement fee |

| Dividends Earned |

None | None | None | |

| ATM Surcharge Refund |

Up to $15/month | Up to $15/month | Up to $15/month | Up to $5/month |

| Anywhere Banking Tools |

||||

| Fuel Discounts 4 |

||||

| Roadside Assistance |

||||

| Cell Phone Protection 1,2 |

||||

| ID Theft Aid 1,2 |

||||

| BillShark 3 |

||||

| Buyer's Protection and Extended Warranty 1,2 |

||||

| Health Savings Card | ||||

| Shop Local, Save Local with the ABNB Value+ app, powered by BaZing |

1. Subject to the terms and conditions detailed in the Guide to Benefits.

2. Insurance products are: NOT A DEPOSIT. NOT FEDERALLY INSURED. NOT AN OBLIGATION OR GUARANTEED BY THE CREDIT UNION, ITS AFFILIATES, OR ANY GOVERNMENT AGENCY.

3. Billshark requires additional activation to begin.

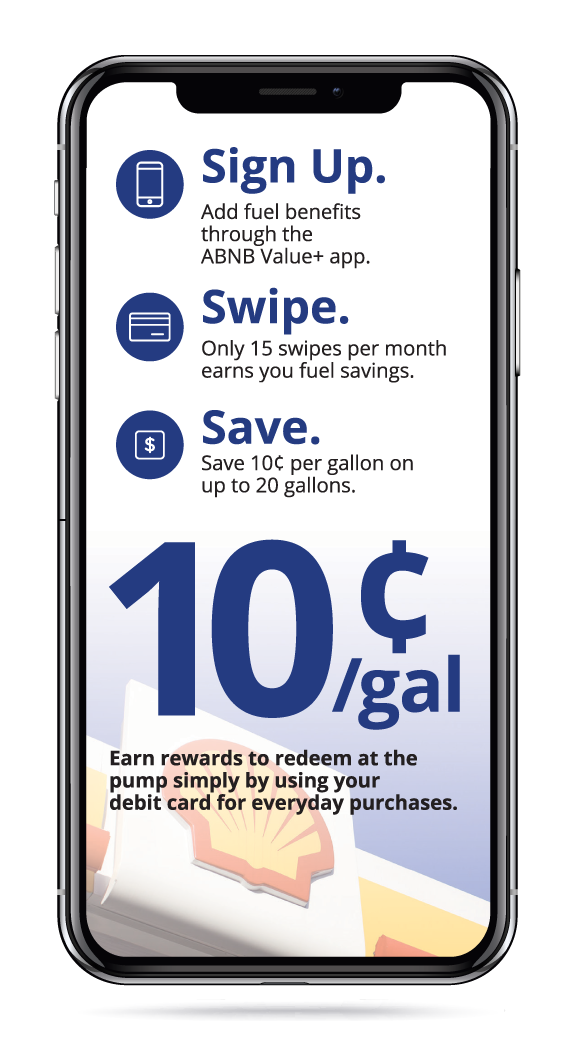

4. You’ll receive a one-time activation reward of $0.10 per gallon when you activate BaZing Fuel. You’ll earn a monthly reward of $0.10 per gallon each month when you have 15 eligible debit card transactions post and settle during the Monthly Qualification Cycle (MQC), which is defined as the first day of the month through the last day of the month. Only transactions posted during the MQC will count towards the monthly reward for that MQC. The following activities do not count toward earning BaZing Fuel: ATM withdrawals, transfers between accounts, deposit or refund transactions. Transactions posted during the MQC greater than the monthly reward requirement will be stored to count towards a bonus reward of $0.10 per gallon. When you have 50 stored bonus transactions you will earn the bonus reward. You will continue to earn bonus rewards for every 50 stored bonus transactions accrued. If the required monthly reward transaction count is not met during the MQC, no transactions are counted for any reward during that MQC or the bonus reward. BaZing Fuel is limited to 20 gallons of fuel per purchase, per vehicle, or fraud limits placed by Shell and/or limits placed on your payment card by your financial institution, each of which may be lower. To activate, you will need to have online banking with your financial institution. Refer to the BaZing Fuel Terms and Conditions for full disclosures. BaZing Fuel offer may be changed at any time and without notice.

{beginAccordion h2}

Everyday Value

Our most popular account provides great value-added benefits that make your life easier.

Our most popular account provides great value-added benefits that make your life easier.

Enjoy money-saving benefits you can use every day through the ABNB Value+ app powered by BaZing. Benefits include Roadside Assistance, Cell Phone Protection, ID Theft Aid plus hundreds of local and national merchant discounts and more.

- $20 minimum to open

- No minimum monthly balance required

-

Up to $15/month in ATM surcharge rebates

-

$4.00/month paper statement fee waived with eStatements

-

$5.95 monthly service fee

Download the ABNB Value+ App for iPhone

Download the ABNB Value+ App for Android

Everyday Earnings

Earn dividends on your account with value-added benefits just for you.

- $20 minimum to open

- Dividends earned on entire balance

- $5,000 average daily balance required to avoid $8.95 monthly service fee

- Up to $15/month in ATM surcharge rebates

- Get one free standard box of checks at account opening

- $4.00/month paper statement fee waived with eStatements

Download the ABNB Value+ App for iPhone

Download the ABNB Value+ App for Android

Young Adult

This account is specifically designed for 18-24 year old’s. You receive all the great benefits of our Everyday Value account at a significant discount. Enjoy money-saving benefits you can use every day through the ABNB Value+ app powered by BaZing. Benefits include Roadside Assistance, Cell Phone Protection, ID Theft Aid plus hundreds of local and national merchant discounts and more.

-

$20 minimum to open

-

No minimum monthly balance required

-

Up to $15/month in ATM surcharge rebates

-

$4.00/month paper statement fee waived with eStatements

-

$2.95 monthly service fee

-

Must be 18-24

Download the ABNB Value+ App for iPhone

Download the ABNB Value+ App for Android

Military

This account is specifically designed for active duty/retired military, veterans, spouses, and children. You receive all the great benefits of our Everyday Value account at a significant discount. Enjoy money-saving benefits you can use every day through the ABNB Value+ app powered by BaZing. Benefits include Roadside Assistance, Cell Phone Protection, ID Theft Aid plus hundreds of local and national merchant discounts and more.

-

$20 minimum to open

-

No minimum monthly balance required

-

Up to $15/month in ATM surcharge rebates

-

$4.00/month paper statement fee waived with eStatements

-

$2.95 monthly service fee

-

Must be active duty/retired military, veterans, spouses, and children to qualify

Download the ABNB Value+ App for iPhone

Download the ABNB Value+ App for Android

Everyday Freedom

Enjoy our basic, no-frills, no-cost account that saves you money every day.

Take advantage of our free, basic account that saves you money every day.

-

$20 minimum to open

-

No minimum monthly balance required

-

No monthly service fees

-

Up to $5/month in ATM surcharge rebates

-

$4.00/month paper statement fee waived with eStatements

Checking Perks & Benefits

The Everyday Earnings, Everyday Value, Young Adult, and Military accounts include the following great benefits. Sign up today.

Fuel 4

Earn 10¢/gal for up to 20 gallons each month with just 15 debit card swipes.

Roadside Assistance

Available 24/7 and free to use, up to $80 in covered service charges.

Cell Phone Protection 1,2

Receive up to $400 per claim ($800 per year) if your cell phone is broken or stolen.

ID Theft Aid 1,2

Includes identity restoration & payment card resolution and up to $2,500 in personal identity benefit.

Billshark 3

Let our team of experts negotiate your internet, TV, cell phone, and home security services on your behalf, or cancel subscriptions you no longer want or need.

Buyer’s Protection and Extended Warranty 1,2

Items are protected for up to $2,500 per item if theft or accidental breakage occurs during the first 180 days of purchase, using your ABNB account, powered by BaZing.

Health Savings Card

Save money on prescriptions, eye exams, frames, lenses and hearing services.

Shop Local, Save Local with ABNB Value+, powered by BaZing

Local discounts and national retailer deals to save you money on shopping, dining, travel & more.

Check out all the perks & benefits

BaZing Mobile App for Credit Union Members - BaZing

1. Subject to the terms and conditions detailed in the Guide to Benefits.

2. Insurance products are: NOT A DEPOSIT. NOT FEDERALLY INSURED. NOT AN OBLIGATION OR GUARANTEED BY THE CREDIT UNION, ITS AFFILIATES, OR ANY GOVERNMENT AGENCY.

3. Billshark requires additional activation to begin.

4. You’ll receive a one-time activation reward of $0.10 per gallon when you activate BaZing Fuel. You’ll earn a monthly reward of $0.10 per gallon each month when you have 15 eligible debit card transactions post and settle during the Monthly Qualification Cycle (MQC), which is defined as the first day of the month through the last day of the month. Only transactions posted during the MQC will count towards the monthly reward for that MQC. The following activities do not count toward earning BaZing Fuel: ATM withdrawals, transfers between accounts, deposit or refund transactions. Transactions posted during the MQC greater than the monthly reward requirement will be stored to count towards a bonus reward of $0.10 per gallon. When you have 50 stored bonus transactions you will earn the bonus reward. You will continue to earn bonus rewards for every 50 stored bonus transactions accrued. If the required monthly reward transaction count is not met during the MQC, no transactions are counted for any reward during that MQC or the bonus reward. BaZing Fuel is limited to 20 gallons of fuel per purchase, per vehicle, or fraud limits placed by Shell and/or limits placed on your payment card by your financial institution, each of which may be lower. To activate, you will need to have online banking with your financial institution. Refer to the BaZing Fuel Terms and Conditions for full disclosures. BaZing Fuel offer may be changed at any time and without notice.

Overdraft Protection

In the event that the funds in your checking account are insufficient, overdraft protection provides peace of mind.

Overdraft Options*

- From Your Savings Account. In accordance with federal regulations, you may transfer up to six times per month from any savings account designated to cover non-sufficient funds. You must choose the overdraft option to be active.**

- From Your Overdraft Line of Credit. Alternately, you may apply for an ongoing Line-of-Credit. The interest rate for the Line-of-Credit depends on your credit qualifications. You must choose the overdraft option and specify which account will provide the primary overdraft funds.

- Courtesy Pay. The Courtesy Pay program is offered on qualified checking accounts. Courtesy Pay is an overdraft program that provides added financial security and peace of mind. Courtesy Pay is a privilege service and not a loan; it is not tied to a note, line of credit, or savings option. When you enroll and qualify in Courtesy Pay you can overdraw your share draft checking accounts to a pre-set limit, and retain this privilege by bringing your checking account to a positive balance within a designated time limit.

Courtesy Pay is activated only after available funds in other share/savings accounts that you have previously set up for overdraft protection have been transferred to clear checking account items. ABNB may honor overdrafts of individual share draft checking accounts subject to certain conditions and limitations as set forth in the following policy:

Maximum Overdraft Protection Limits

- $100 for new accounts less than 45 days

- $600 for accounts 46 days or older

Qualifying Criteria

- Members who have opted in to Courtesy Pay, and

- Have a regular deposit of at least $50.00 per month, and

- Bring the account to a positive balance at least once every 30 days

- Accounts must be in good standing

- Courtesy Pay is limited to one checking account per primary member

Non-Qualifying Factors

- ABNB charged-off, garnished and/or bankruptcy accounts

- Currently delinquent 30 days or more on loans

- Currently negative account balance over 30 days

- Accounts that have gone delinquent on loans within the first 45 days, or had a negative balance for more than ten days will be permanently disqualified from Courtesy Pay

- Enrolled in Debt Management Program

- Under 18 years of age

- Business/commercial accounts

- Bad address

- Estate/trust accounts

- Other negative account activities at Management's discretion

- Checking account declined by Chex Systems

Overdraft Protection and Fee Information

- Courtesy Pay fees — $35 per item

There is no interest charged on any overdraft or unpaid overdraft charge. There will be no late charges or other fees other than the overdraft fee. - The following service channels are included for overdraft protection:

- Checking

- Bill Pay

- ACH debits

- One-time debit card transactions

Courtesy Pay limits are included in the “available balance” authorizations on Visa Debit Card transactions only. The Courtesy Pay limit is not disclosed to members on any other type of transaction or available balance information, i.e. ATMs, Self-Service Telephone Banking, Online Banking, etc.

*Overdraft Protection Plan. If we have approved an overdraft protection plan for your account, we will honor checks drawn on insufficient funds by transferring funds from another account under this Agreement or a loan account, as you have directed, or as required under the Credit Union’s overdraft protection policy. The fee for overdraft transfers, if any, is set forth in the Truth-In-Savings Disclosure. This Agreement governs all transfers, except those governed by agreements for loan accounts.

**If, on any day, the funds in your savings account are not sufficient to cover checks, fees or other items posted to your account, we may pay or return the overdraft in accordance with our overdraft policy or an overdraft protection plan you have with us. The Credit Union’s determination of an insufficient account balance may be made at any time between presentation and the Credit Union’s midnight deadline with only one review of the account required. We do not have to notify you if your account does not have funds to cover checks, fees or other posted items. Whether the item is paid or returned, your account may be subject to a charge as set forth in the Truth-in-Savings Disclosure. Except as otherwise agreed in writing, we, by covering one or any overdraft, do not agree to cover overdrafts in the future and may discontinue covering overdrafts at any time without notice. If we pay a check or impose a fee that would otherwise overdraw your account, you agree to pay the overdrawn amount in accordance with our overdraft policy.

ClickSWITCH

Switching Your Checking Account To ABNB Is Fast, Safe & Easy With ClickSWITCH™

Moving your checking account is easier than ever. ClickSWITCH is our user-friendly digital tool that allows you to quickly and seamlessly move your direct deposit plus automatic and recurring payments from your current financial institution to ABNB in just a few clicks. Just log into ABNB’s online banking to get started and follow the simple steps below.

Benefits of ClickSWITCH

- Easily search a company or financial institution… the information will pre-populate for you

- Use e-signature to securely submit forms for each of your switches and closures

- SwitchAssist allows your transaction information to be quickly imported from your financial institution. Simply select the account that you use for automatic payments, direct deposit(s) and Bill Pay and your transaction history will be populated in the sections based on your specific transactions.

Switching is Easy as 1, 2, 3!

- Log into ABNB’s online/mobile banking

- Click on the MORE icon, select CLICKSWITCH and click Open

- Click on the switch options provided and follow the instructions

Here’s What You’ll Need To Make The Switch

- Your current direct deposit information and the addresses of your depositor(s)

- All automatic and recurring payment information including company names and addresses, login information and your account numbers

Check Order Tracking Now Available

We have a new check order tracking service available to help members track their new box(es) of checks. Text message notifications about shipping staus and expected delivery date(s) are part of this new service. ABNB has launched this new service for members as of Sunday, February 5th.

To order and track your checks, log into Online Banking:

- Find Digital Services in the top menu bar

- Select Stop Pmt/Order Checks

- Select the Reorder Checks tab

- Select Order Checks

{endAccordion}

Consumer Checking Account Disclosure

APY = Annual Percentage Yield. Rates accurate as of 08/08/2022. Rates subject to change without notice. Fees could reduce earnings. $20 minimum deposit to open. $5,000 average daily balance required to avoid $8.95 monthly service fee. Dividend rate may change after opening account.